The Financial Ladder: The Ultimate Guide to Accounts for Students & Pros

From zero balance to building wealth: A step-by-step decision tree to choosing the right financial account for every stage of your life.

Whether you’re a student with $50 to your name or a professional managing a growing portfolio, the banking world is intentionally confusing. Banks want you to leave money in 0.01% checking accounts because they make billions off your inaction.

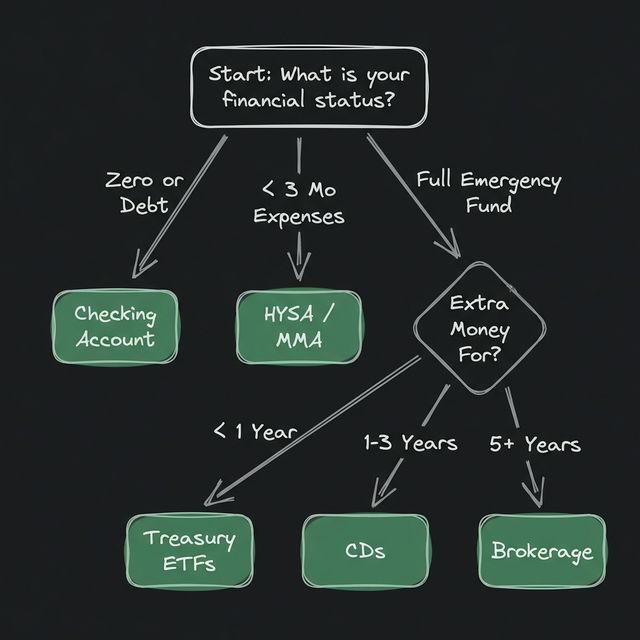

This guide cuts through the noise. We’ve built a Financial Decision Tree to tell you exactly which account you need right now based on your current financial health.

The Financial Decision Tree

Start at the top. Where do you fit?

Level 1: The Foundation (Checking Account)

Who is this for? Everyone. This is your transactional hub. The Goal: Pay bills, receive salary, and avoid fees.

A Checking Account is where your financial life lives day-to-day. Money comes in (salary, Venmo), and money goes out (rent, credit card bills).

- The Golden Rule: Never pay a monthly fee. There are too many free options (like SoFi or Capital One) to ever pay a bank for holding your money.

- Student/Pro Tip: Keep 1-2 months of expenses here as a “buffer” to avoid overdrafts. Do not hoard cash here; you are losing money to inflation every day it sits.

👉 See the Best Checking Accounts for Feb 2026

Level 2: The Safety Net (HYSA / MMA)

Who is this for? Anyone building an Emergency Fund. The Goal: Safety + Access + Inflation protection.

Once you have your checking account sorted, your first priority is survival. You need an Emergency Fund covering 3-6 months of basic living expenses. This money protects you from layoffs, medical bills, or car repairs.

- High-Yield Savings Account (HYSA): Like a regular savings account, but pays 10x-50x more interest (currently ~4.00% - 5.00%).

- Money Market Account (MMA): Similar to a HYSA but often comes with a debit card or check-writing privileges. Great if you want easier access to your emergency cash.

👉 Compare Best HYSAs | 👉 Compare Best MMAs

Level 3: Optimized Cash (Treasury ETFs & Money Market Funds)

Who is this for? Professionals identifying “lazy cash” in their portfolio. The Goal: Higher tax efficiency and yields for short-term savings.

You have your Emergency Fund. Now you have an extra $5,000 or $10,000 sitting around. You could put it in a HYSA, but if you live in a high-tax state (CA, NY), the government seeks to take a chunk of that interest.

Enter Treasury ETFs and Money Market Funds (MMFs).

- Treasury ETFs (e.g., SGOV, USFR): Behave like stocks but hold US Government debt.

- Why: Ultra-safe and exempt from state/local income taxes.

- Yield: Often matches or beats HYSAs.

- Money Market Funds (e.g., VMFXX, SWVXX): Mutual funds that invest in short-term debt.

- Why: Convenient cash management within your brokerage account.

- Yield: Competitive with HYSAs, often ~5.00%+.

- Risk: These are SIPC insured (protects against broker failure) but not FDIC insured. However, since they hold US Government debt, the “market risk” is virtually zero.

Level 4: The Lockbox (Certificates of Deposit)

Who is this for? Savers with a specific deadline (Wedding, House Down Payment). The Goal: Lock in a high rate before the Fed cuts interest rates.

If you know you won’t need this money for 1, 2, or 5 years, a CD is a powerful tool.

- The Trade-off: You give up access (liquidity) in exchange for a guaranteed fixed rate.

- When to use: You are saving for a house in 2 years. You don’t want to risk the money in the stock market, but you want to guarantee a 4% return even if savings account rates drop to 2%.

👉 See the Best CD Rates for Feb 2026

Level 5: The Wealth Builder (Brokerage Account)

Who is this for? Anyone investing for >5 years (Retirement, Financial Independence). The Goal: Grow wealth faster than inflation.

This is where “saving” stops and “investing” begins.

- Vehicle: Brokerage Account (Taxable, IRA, or Roth IRA).

- Engine: Stocks, ETFs (like VOO or VTI).

- Time Horizon: 5+ years. The stock market is volatile in the short term but has historically returned ~10% annually over long periods.

Strategy:

- Max out your Roth IRA first (Tax-free growth!).

- Then, use a Taxable Brokerage Account for limitless investing.

👉 See the Best Brokerage Accounts for Feb 2026

Summary Checklist

- Open a Free Checking Account. (No monthly fees).

- Build an Emergency Fund in a HYSA/MMA (3-6 months expenses).

- Optimize “Lazy Cash” into Treasury ETFs or MMFs (especially in high-tax states).

- Lock in Rates with CDs for medium-term goals (1-3 years).

- Invest for Wealth in a Brokerage Account (5+ years).

Disclaimer: This is not a financial advice and Maxint is not affiliated with any financial instiution, product or service.