The Founder's Stack: The Ultimate Guide to Financial Accounts for Startups & SMEs

From day one to IPO: A guide to choosing the right banking stack for freelancers, bootstrapped founders, and venture-backed startups.

Whether you’re freelancing from a coffee shop or raising Series A, your banking stack is the operating system of your business. The wrong choice means frozen funds, painful audits, and thousands of dollars in lost yield.

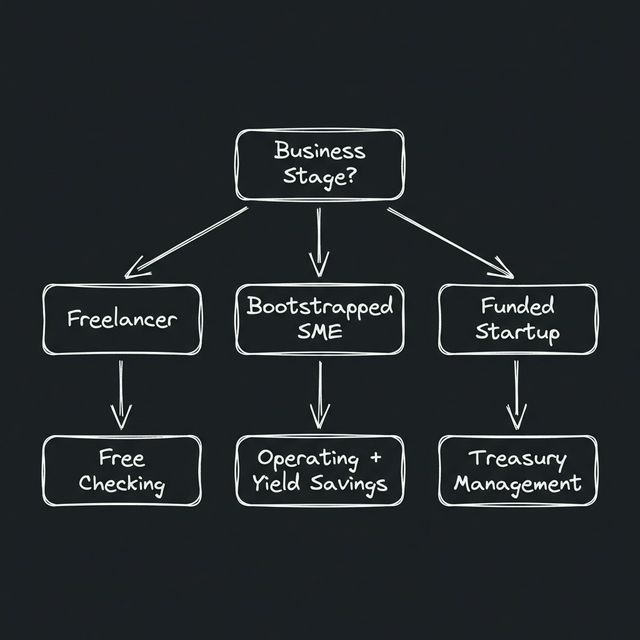

This guide categorizes the financial stack based on your Business Stage.

The Business Financial Decision Tree

Where is your business today?

The Cardinal Rule: Church and State

Before we begin: Never mix personal and business finances. Even if you are a sole proprietor, open a separate business checking account. It simplifies taxes, protects your personal assets (limited liability), and looks professional.

Level 1: The Operator (Business Checking)

Who is this for? Every business. This is your command center. The Goal: Receive revenue, pay payroll, and integrate with accounting software (Quickbooks/Xero).

- For Tech Startups: Mercury or Brex.

- Why: Built for scale, API access, free wire transfers, and dashboards that don’t look like Windows 95.

- 👉 Deduce the Best Startup Bank for You (Comparison)

- For Local SMEs / Cash Businesses: Chase Business or local credit unions.

- Why: You need a physical branch to deposit cash. Online-only banks (neobanks) cannot accept cash deposits easily.

- For Freelancers: Novo or Bluevine.

- Why: No monthly fees, “Profit First” sub-accounts (Novo), and interest on checking balances (Bluevine).

Level 2: The Runway (Treasury & Yield)

Who is this for? Startups with >$250k in cash or funded companies. The Goal: Extend your runway by earning 4-5% on idle cash without risking it.

If you just raised $2M, leaving it in a standard checking account is negligent. You are losing ~$100k/year in risk-free interest. And crucially: FDIC insurance only covers up to $250k. If your bank fails (remember SVB?), money above that limit is at risk.

- Treasury Management: Accounts that automatically sweep excess cash into US Treasury Bills.

- Why: Gov debt is often state-tax exempt and backed by the “full faith and credit” of the US.

- Providers: Mercury Treasury, Rho, Meow, or Arc.

- Business HYSAs: For smaller balances (~$50k-$250k).

- Providers: Live Oak Bank, LendingClub.

Level 3: The Growth Engine (Corporate Credit)

Who is this for? Businesses spending on ads, software, or travel. The Goal: Float expenses (cash flow) and earn rewards.

- The Unicorn Cards: Ramp and Brex.

- Pros: High limits based on cash in bank (no personal guarantee), excellent expense management software (receipt matching), 1.5% cashback.

- Cons: Must be a registered corporation (C-Corp/LLC) with significant cash.

- The Points King: Chase Ink Business Preferred.

- Pros: Massive points on ads and travel.

- Cons: Requires a personal guarantee (hard pull on your personal credit).

Summary Checklist for Founders

- Incorporate (LLC or C-Corp) and get your EIN.

- Open Operating Account (Mercury/Relay/Chase) immediately.

- Set up Treasury if you have >$250k (Protect your runway!).

- Get a Corporate Card (Ramp/Brex) to manage spend and receipts.

- Connect everything to your Accounting Software (Quickbooks/Xero).

Disclaimer: This is not financial advice. Maxint is not affiliated with any financial institution. Rates and terms are subject to change.